- Culture Shock

- Posts

- How Our 2021 VMS Report Saw the GLP-1 Future Coming

How Our 2021 VMS Report Saw the GLP-1 Future Coming

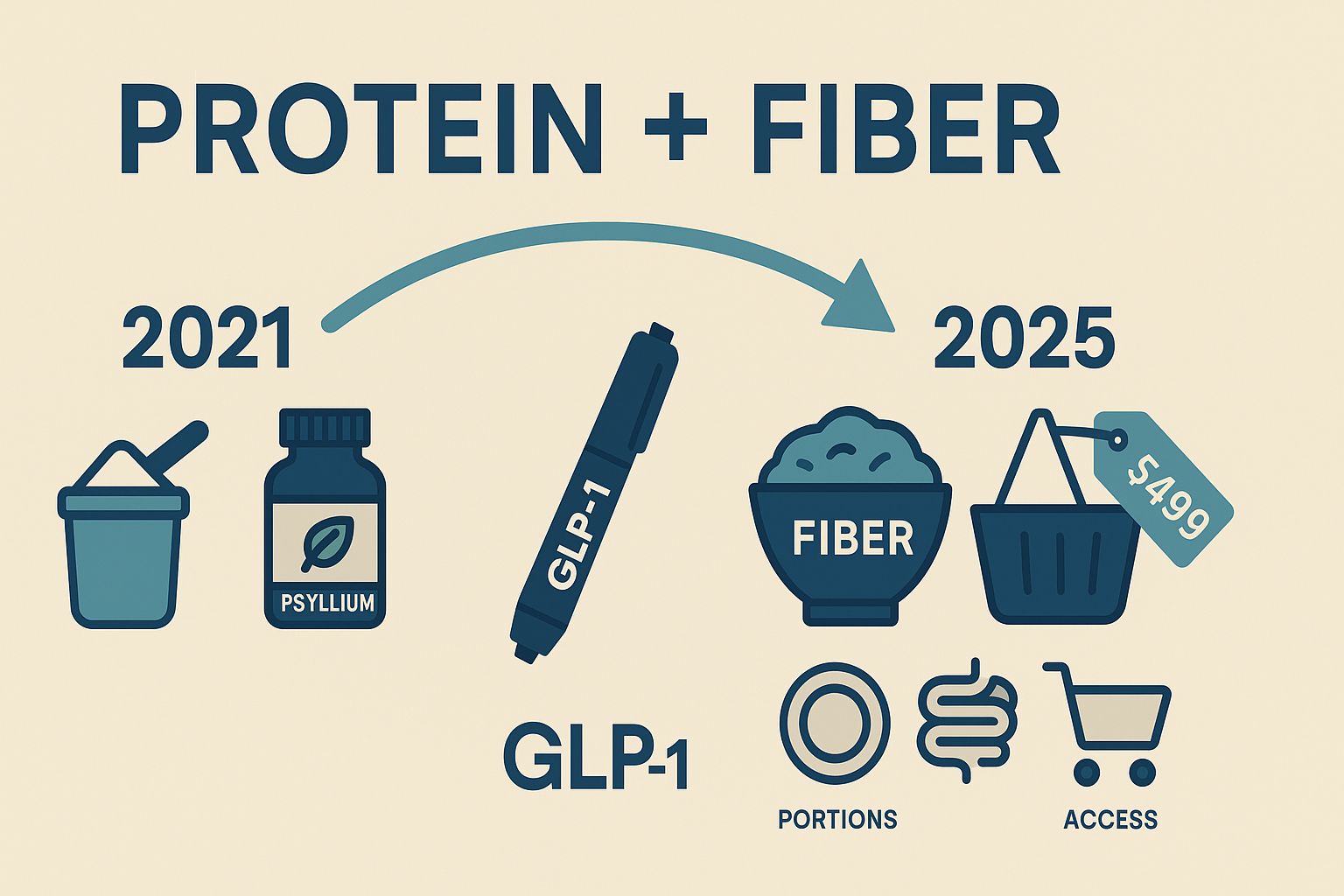

There’s a rare moment in insights work when the fog lifts and you can actually see the next curve in the road. Back in 2021, our early Nichefire work (originally called this TrendFire) on vitamins, minerals, and supplements did exactly that. We flagged a shift from diet-as-discipline to diet-as-design. Consumers weren’t just chasing “weight loss” anymore. They were rebuilding meals around satiety, digestion, and strength. Translation for brands: high protein plus high fiber would be the cultural rails a lot of health behavior would run on.

Then GLP-1s crashed the party.

This piece is the receipts. What we predicted, what happened, and what to do with it if you build products, positioning, or portfolios in health, wellness, or food and beverage.

What we called early (and where it shows up in black and white)

In our sample VMS deck (codifying the early work), two things jumped off the page:

The ingredients

“Top trending ingredients include Vitamin D, Vitamin C, Psyllium Husk, and Whey Protein.” That write-up added a key tell: psyllium was picking up a weight loss association, not just “keeps you regular,” while whey held the protein spotlight for fitness.The pattern shift

Weight loss behavior was “transforming into a high-protein and high fiber diet,” with leading ingredients called out by name: whey protein and psyllium husk. The verbatims backed it up. One user put it plainly: “Eat your protein… and get enough fiber.” Another directly tied psyllium husk to weight loss.

If you’re keeping score, that’s high protein plus high fiber, years before today’s GLP-1-era grocery carts began to look like protein math notebooks and fiber hacks. We weren’t just sniffing around the right aisle. We were already sketching the planogram.

Then GLP-1s mainstreamed… and validated the bet

GLP-1 adoption moved from niche diabetes therapy to cultural phenomenon. The conversation in our GLP-1 trend compendium makes that clear. It documents a world where GLP-1s are mainstreaming fast, but constrained by cost, and where new cash programs change access. It also captures the “now what” questions that flooded Reddit, TikTok, and news cycles.

Two big effects:

Behavioral gravity shifted to satiety, portioning, and protein. Users newly living with less hunger were asking how to eat when you’re not hungry, and food companies felt it in briefs and innovation roadmaps. Nestlé’s Vital Pursuit—portion-aware frozen meals “rich in protein, fiber, and essential nutrients” for GLP-1 users—emerged from this cultural signal field (we helped).

The fiber spike wasn’t a fad. It became functional. The GLP-1 doc tracks a distinct “GLP-1 fiber supplementation” trend, describing how prebiotic fibers and routines like psyllium dosing are being used to improve gut comfort, mitigate constipation, and support blood sugar control while on GLP-1s. In plain English, fiber moved from grandma’s pantry to being a GLP-1 companion.

When you combine those two, our 2021 call reads less like a hunch and more like a blueprint.

Psyllium husk: the unlikely star (and why it matters)

The culture piece around psyllium husk rhymes perfectly with the deck’s early signal. Today it shows up in four overlapping roles:

GLP-1 sidekick

Psyllium helps address constipation, a common GLP-1 side effect, and gives users a gentle appetite-control “guardrail” when their hunger cues are weird. That’s now a full-blown trend with its own vocabulary, tutorials, and dosing tips.Satiety support

Communities repeatedly describe psyllium as a hunger buffer. The GLP-1 report documents “Psyllium Husk for Appetite Control,” with users mixing it in water for fullness.Metabolic helper

The same compendium details psyllium’s role in glycemic control and LDL reduction. People talk about it as “nature’s Ozempic” (the analogy is imperfect, but the meme move matters).A visible consumer ritual

TikTok and Reddit have normalized the routine. Before-and-after posts, recipe hacks, brand comparisons, and “morning psyllium” videos echo across feeds. That makes psyllium not just a supplement, but a behavior that brands can design around.

To be clear: Psyllium is not a GLP-1. It does not replicate the pharmacology. But as a complement for users on drug therapy and a lower-lift alternative for those priced out or opting out, it’s real, cultural, and sticky.

Our 2021 work said psyllium would matter for weight loss and digestion. The 2025 conversation confirms it.

High protein isn’t a “trend.” It’s infrastructure.

GLP-1s didn’t create protein culture. They accelerated it. The same deck that named psyllium also named whey protein as the prominent anchor for fitness and weight management. That shift toward building muscle and eating for strength is now table stakes in food and bev.

If you run innovation, this matters because:

Portion-aware SKUs plus protein-forward macros read as empathetic, not punitive. Vital Pursuit’s positioning is a case in point, and it isn’t the only one moving.

“Protein math” is now a shopper behavior. People literally keep a running cost-per-protein mental model. If your portfolio doesn’t support easy protein budgeting, you’re already losing the shelf talk.

Prices and the access reality check

Part of the culture story is economic. GLP-1s are expensive, which is why supplements and “food solutions” grow in the gaps. Our GLP-1 packet captures the price landscape clearly. It notes cash pricing offers around $499 per month that expanded access and created new adoption cohorts. Even so, the list prices are high, which keeps the “GLP-1 plus fiber” or “fiber instead of GLP-1” strategies in play for large segments.

If you model demand, assume a barbell: covered users with strong adherence on one side, and a big middle building GLP-1-adjacent routines through diet, protein, and fiber on the other.

“Microdosing,” oral pills, and the next wave

Culture doesn’t freeze. It pivots. Two emergent signals are worth tracking:

GLP-1 microdosing

It’s everywhere online. The pitch is fewer side effects and lower cost. The catch is thin evidence and safety questions. Treat it as consumer curiosity, not a clinical standard. Messaging should educate gently without condescension.Oral GLP-1s

Once-daily pills are moving through the pipeline. For insights teams, that means the addressable audience widens, adherence patterns change, and “GLP-1-friendly” foods will keep growing because the pool of users keeps growing. (You can feel that in the Nestlé case framing new eating “relationships” as the real design problem.)

Neither trend erases protein plus fiber. If anything, easier GLP-1 access will amplify the need for food that fits the new physiology.

So, was the 2021 call accurate?

Short answer: yes. Longer answer: the signal was right and it scaled.

We forecast high-protein + high-fiber as the new operating system for weight management behavior. That shows up explicitly in the deck’s “transformed into a high-protein and high fiber diet” line with whey protein and psyllium lead roles.

We flagged psyllium husk as both digestive and weight-loss adjacent. The 2025 feed treats psyllium as a GLP-1 complement, an “alternative,” and a daily ritual.

We anticipated the culture flip from “lose weight” to “eat for satiety, strength, and sanity.” That ethos is embedded in Vital Pursuit’s build and in the constant drumbeat of consumer questions like “what should I eat when I’m not hungry.”

If you’re generous, call it predictive. If you’re tough, call it lucky. Either way, it was useful.

What this means for consumer insights leaders (playbook you can use this quarter)

1) Redraw your segments by physiology and mindset, not just demos.

You’re not selling to “women 25–54.” You’re selling to “GLP-1 On,” “GLP-1 Curious,” “GLP-1 Off but GLP-1-informed,” and “Pharma-averse but satiety-seeking.” These cohorts shop differently, eat differently, and scroll differently. Our GLP-1 compendium outlines a ready-made framework for the “GLP-1 + fiber” and “fiber-first” audiences.

2) Write briefs with protein and fiber as non-negotiables.

One line in the early deck reads like a spec: protein powder, psyllium husk. Build formats around those macros and you’ll feel outlandishly on-trend because you are.

3) Design for smaller appetites and slower guts.

Portion-aware, easy-to-chew, high-satisfaction formats win with GLP-1 users and the satiety-seeking crowd around them. Nestlé’s Vital Pursuit is a working example of food that fits a new relationship with hunger.

4) Treat fiber like a feature, not a footnote.

This isn’t a back-panel flex anymore. It’s a front-of-pack reason to believe. If you include psyllium or prebiotic fibers, educate about timing, hydration, and how fiber pairs with protein. The GLP-1 fiber pages show the appetite for “how to” content is real.

5) Build a “GLP-1-friendly spec” that upstream teams can use.

Think calorie band, protein minimum, soluble fiber target, fat composition, bite size, reheat profile, and language guardrails. It’s how you turn trends into predictable pipelines. (We can help you codify this and have done it for clients.)

6) Prepare a price architecture for a barbell market.

List prices are painful. Cash offers exist but fluctuate. That means adjacent solutions—protein snacks, fiber-forward breakfasts, “GLP-1 support” bundles—will keep siphoning demand. Price those with empathy.

7) Don’t get baited by microdosing hype.

Monitor it, but educate carefully. Pair any microdose chatter with clear “what’s proven” messaging. Consumers appreciate honesty more than swagger.

The future: food design for a GLP-1 culture

Here’s my read. We’re moving from “diet products” to metabolic UX. GLP-1s accelerated it, but the behavior change was already brewing, which is why we saw it in 2021.

What will win over the next 18 months:

Protein-first, fiber-smart everyday foods. Cereals, yogurts, bowls, handhelds that quietly meet new satiety math. Make the macros do the talking.

Coaching on rituals, not just claims. Show when to take fiber, how to hydrate, what to eat when appetite is low, and how to sequence protein through the day. The GLP-1 fiber pages scream for responsible guidance.

Formats that respect joy. People miss eating for pleasure. Give them textures, flavors, and portions that feel indulgent within the new physiology. Vital Pursuit’s “portion-aware” frame points the way.

And if you need one final cultural proof point that this isn’t a flash in the pan, listen to what real users are worried about. In our demo transcript, we walked through threads where GLP-1 users fear weight regain, nutrient gaps, and hair loss. That’s not a clickbait headline. That’s a human telling you where the friction is. Products that reduce those frictions win.

The take-home (and why I’m bullish)

Our 2021 work didn’t predict a miracle drug. It predicted the conditions where a drug-driven culture would need new food. High protein plus high fiber. Satiety and strength. Psyllium moving from stool softener to satiety tool. That became the canvas for GLP-1 users and the millions around them who want similar outcomes without a prescription.

If you lead consumer insights, your job isn’t to memorize the acronyms. It’s to draw the new maps. Start with physiology. Layer in emotions. Then specify products and messages people can actually use on busy Tuesdays. In other words, do what we did in 2021, only faster.

I’ll leave you with the same line that keeps proving itself true: eat your protein and get enough fiber. The market is building around that sentence. So should you.

If you want to see the reports and share ideas, reach out to me!